Are you looking for a challenging and rewarding career in finance? If so, then you may want to consider becoming a financial controller. Controller Job Descriptions often require advanced degrees and experience in finance, but the job can be a great fit for those who enjoy analyzing data and making strategic financial decisions. In this post, we'll take a closer look at the roles and responsibilities of a financial controller, as well as tips for succeeding in this career path.

What is a Financial Controller?

An Overview

A financial controller, also known as a comptroller, is a senior-level executive responsible for overseeing the financial operations of a company. This includes managing the accounting department, preparing financial reports, and analyzing financial data to help inform strategic decisions. The financial controller typically reports directly to the CFO (Chief Financial Officer) and serves as a key member of the finance team.

Roles and Responsibilities

What to Expect

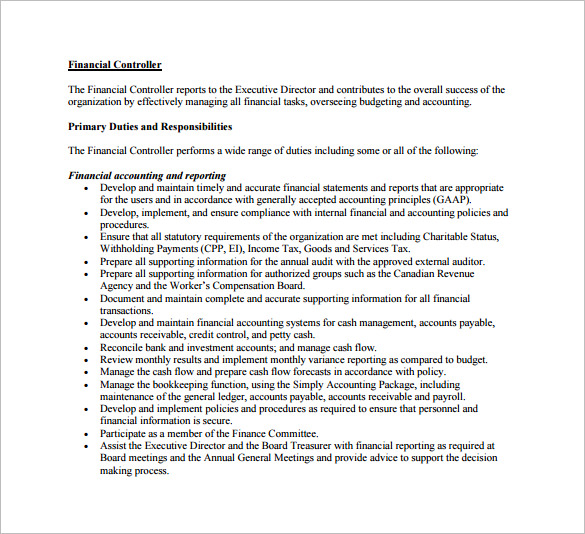

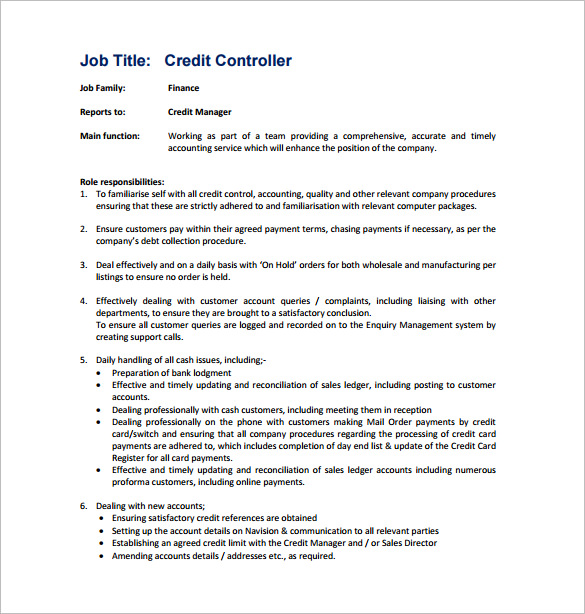

As a financial controller, your primary responsibilities will include managing financial reporting, budgeting, and forecasting. You may also be responsible for managing the day-to-day operations of the accounting department, ensuring compliance with financial regulations and laws, and overseeing the financial audit process. Other duties may include:

- Preparing financial statements and reports

- Managing cash flow and overseeing banking relationships

- Developing financial strategies and policies

- Managing tax accounting and reporting

- Overseeing payroll and employee benefits programs

Education and Experience

What You Need to Know

Most employers require financial controllers to have a bachelor's degree in finance, accounting, or a related field. Some employers may also require a master's degree in business administration (MBA) or finance. In addition to education, most employers seek candidates with a strong background in accounting and finance, as well as experience managing accounting departments or teams.

Professional certifications, such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA), are also highly valued by employers and may help you stand out in a competitive job market.

Skills and Qualities

What Employers Look For

While education and experience are important, employers also look for certain skills and qualities in financial controllers. These may include:

- Strong analytical and problem-solving skills

- Excellent communication and leadership skills

- Ability to work well under pressure and meet tight deadlines

- Attention to detail and a high level of accuracy

- Proficiency in financial reporting and accounting software

Tips for Succeeding as a Financial Controller

How to Excel in Your Career

If you're considering a career as a financial controller, here are a few tips to help you succeed:

- Stay up-to-date on financial regulations and laws

- Develop strong relationships with key stakeholders

- Communicate financial data in a clear and concise manner

- Continuously seek opportunities to improve processes and procedures

- Collaborate with other departments to ensure alignment with overall business goals

By following these tips, you can excel in your career as a financial controller and make meaningful contributions to your organization.

Conclusion

Is a Career as a Financial Controller Right for You?

If you're passionate about finance, have strong analytical skills, and enjoy making strategic decisions, then a career as a financial controller may be right for you. By gaining the education, experience, and skills necessary to succeed in this role, you can make a meaningful impact on your organization and advance your career in finance.

View more articles about Controllers Job Description